are hearing aids tax deductible in australia

The net medical expenses tax offset is no longer available from 1 July 2019. Even the hearing aid batteries are tax-deductible.

5 Tax Write Offs That All Musicians Should Know About Soundfly

Tax deductible hearing aids.

. Medical Expense Tax Offset Thresholds. Rather than letting your hearing aids sit in your home unused donating them will put them to good use. Many of your medical expenses are considered eligible deductions by the federal government.

Forum chair David Brady has. I work in a call centre and have been working from home. Hearing aids are an important investment in your health and while they represent great value for money in terms of the changes they make to your life the initial.

Income tax rebate for hearing aids. They come under the category of medical expenses. The only eligible medical expenses that can be claimed under the Net Medical Expenses Offset in 2016 must relate to disability aids attendant care or aged care.

You may still be eligible for this offset for income years from 201516 to 201819. I know there used to be an offset for medical expenses but that ended in 2019. You can only deduct medical.

19 minutes agoThe US House Oversight Committee requested National Football League Commissioner Roger Goodell and Washington Commanders team owner Dan Snyder to testify. In order for hearing aids or other medical expenses to qualify as tax-deductible the total cost of all medical expenses will need to be greater than 75 percent of your adjusted gross income. You can deduct the cost of a hearing aid as a medical expense as well as its batteries repairs and necessary maintenance for it.

Urgent changes are needed to tax rules to allow hearing aids to be claimed as a workplace deduction the Deafness Forum of Australia says. Keep in mind due to Tax Cuts and Jobs Act tax reform the 75 threshold applies to tax years 2017 and 2018. Turbo tax a popular tax preparation software also ensure that hearing aids are tax-deductible.

Expenses related to hearing aids are tax. As one of Melbournes longest established providers of hearing aids Expression Audiology fits and services all the leading brands. For your hearing aids and hearing aid accessories to be tax-deductible you need to meet certain criteria.

Only medically required equipment is eligible to be deducted. Sneaky claims like cosmetic surgery golf club memberships or even artificial limbs are some of the deductions that the tax man wont let you get away with. A single person with a.

Line 330 of your tax return should be filled out with any. Once you determine whether you are eligible you then must apply for a voucher which can be used to redeem subsidised hearing services. Medical expenses tax offset.

The good news is that if you have an income and pay income tax you can claim a tax offset for any out-of-pocket costs on your hearing aids. A single person with a taxable income of less than 88000 can claim 20 of net medical expenses over 2162. Hearing aids and insurance.

The sale of medical aids and appliances is GST-free if they meet certain conditions including being listed in schedule 3 to. Hearing aids batteries maintenance. Claims for this offset are restricted to net eligible expenses for.

IRS Publication 502 spells out allowable. So if you need a hearing aid just for your work. You can purchase the latest.

Discover the amount you and your family are able to claim on tax rebates for hearing aids. The tax rules state that if the expense is incurred wholly and exclusively for your business then you can have tax relief for it. Expression Australia is a registered charity under our.

However I use my hearing aids directly for work. The rules state that if your hearing aids are to be. This can be online and in many cases an.

For 2017-2018 you would be. If you earn an income and. As long as your husband or wife pays for the hearing aids or accessories within the past year and your private insurance does not reimburse them you can enjoy an exemption from paying business and personal taxes.

After 2018 the floor returns to 10. If you use the standard deduction you cannot deduct any medical expenses. Whats more if youre interested donating used hearing aids is typically.

Tax offsets are means-tested for people on a higher. Physician visits prescriptions for eyeglasses contact lenses false teeth hearing aids and appliances Can You Claim Medical Expenses On Tax. Individuals are eligble to claim up to 20 of medical expenses.

Since hearing loss is. Supply of medical aids and appliances used for treating COVID-19. Examples would include.

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Overlooking The Assisted Living Tax Deduction Can Be Costly Alee Solutions Tax Deductions Deduction Assisted Living

Worried About Taxes Going Up 9 Ways To Reduce Tax

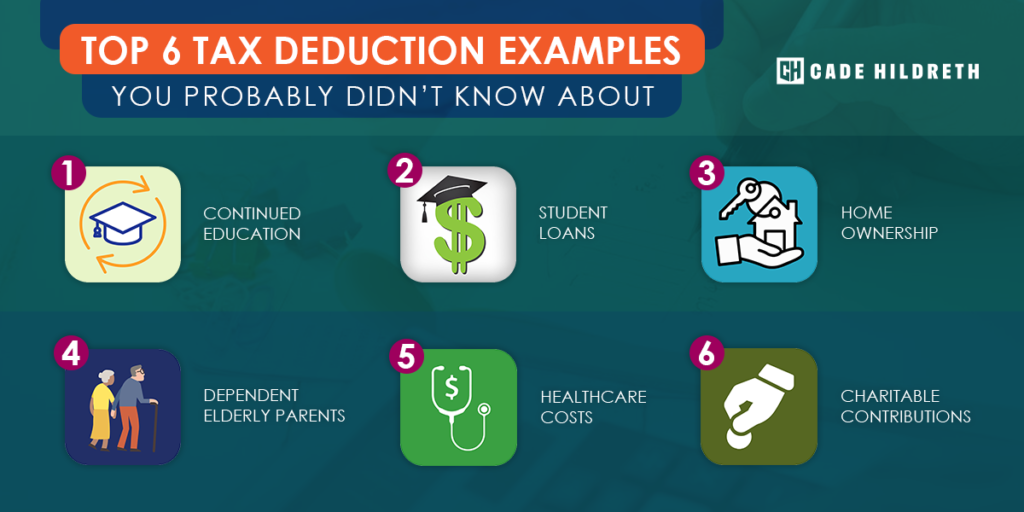

Top 6 Tax Deduction Examples You Probably Didn T Know About

5 Tax Write Offs That All Musicians Should Know About Soundfly

Are Medical Expenses Tax Deductible Australia Ictsd Org

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Are Medical Expenses Tax Deductible

Are Hearing Aid Batteries Tax Deductible In Canada Ictsd Org

Working From Home Doesn T Always Equal A Home Office Tax Deduction Even If You Have No Other Option

Are Medical Expenses Tax Deductible In Australia Ictsd Org

Working From Home Your Home Offices Expenses Are Probably Not Tax Deductible

Are Hearing Aids Tax Deductible Sound Relief Hearing Center

Are Hearing Aids Tax Deductible In Australia Ictsd Org

Irs Announces 2016 Tax Rates Standard Deductions Exemption Amounts And More

Income Tax Act Laws Online Government Of Antigua And Barbuda

17 Things You Can T Claim In Your Tax Return Platinum Accounting Taxation

Overlooking The Assisted Living Tax Deduction Can Be Costly Alee Solutions Tax Deductions Deduction Assisted Living