price to cash flow from assets formula

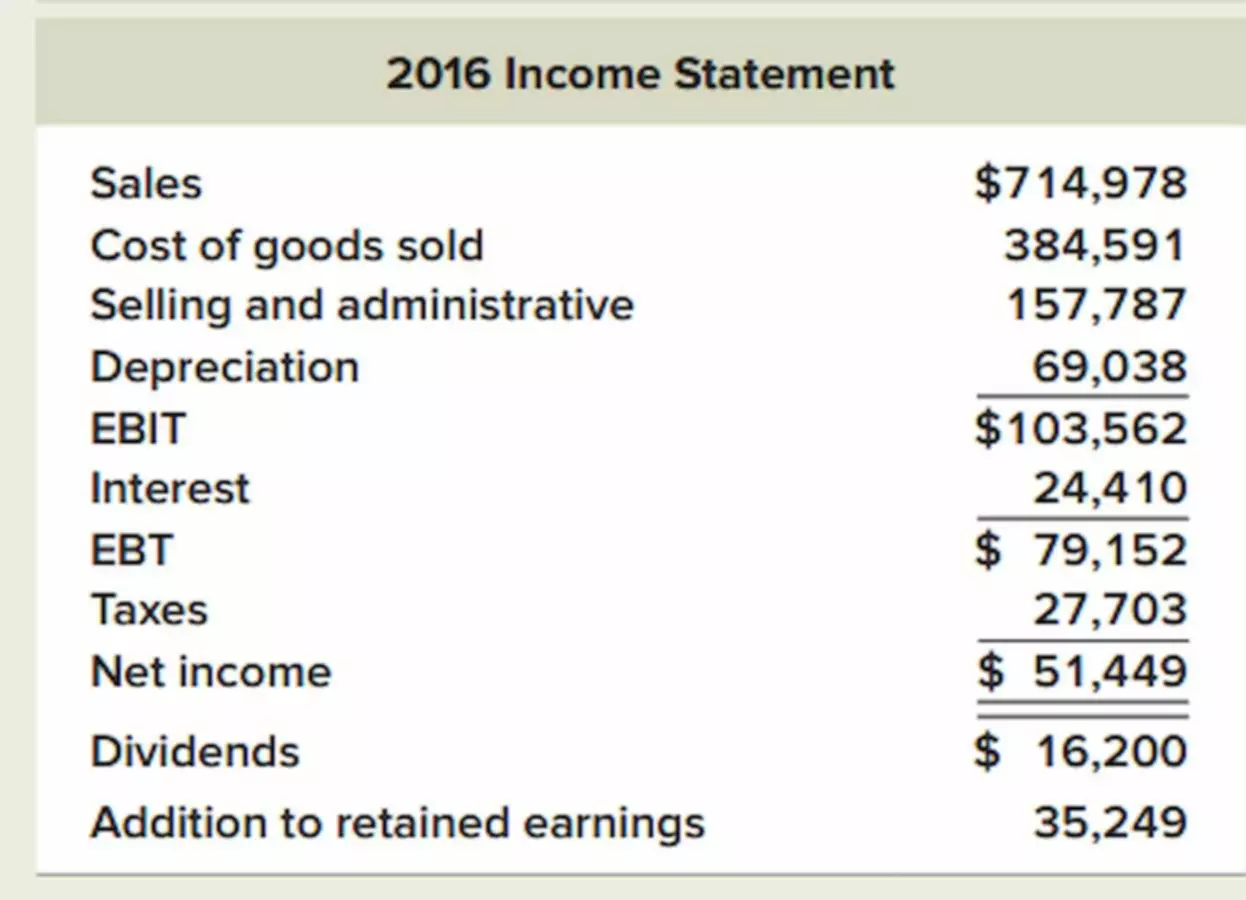

Cash Flow from Operations Net Income Depreciation Adjustments to Net Income Changes in Accounts Receivables. Price to Cash flow Ratio.

Cash Flow From Assets Definition And Formula Bookstime

Formula for the Price-to-Cash Flow Ratio.

. Its OCF per share is as follows. The Price - Cash Flow Ratio Formula The PCF ratio is the market price per share divided by the cash flow per share. The company has anOCFof 200 million in a given year.

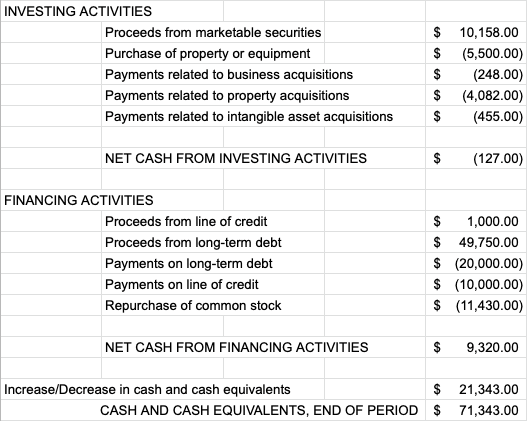

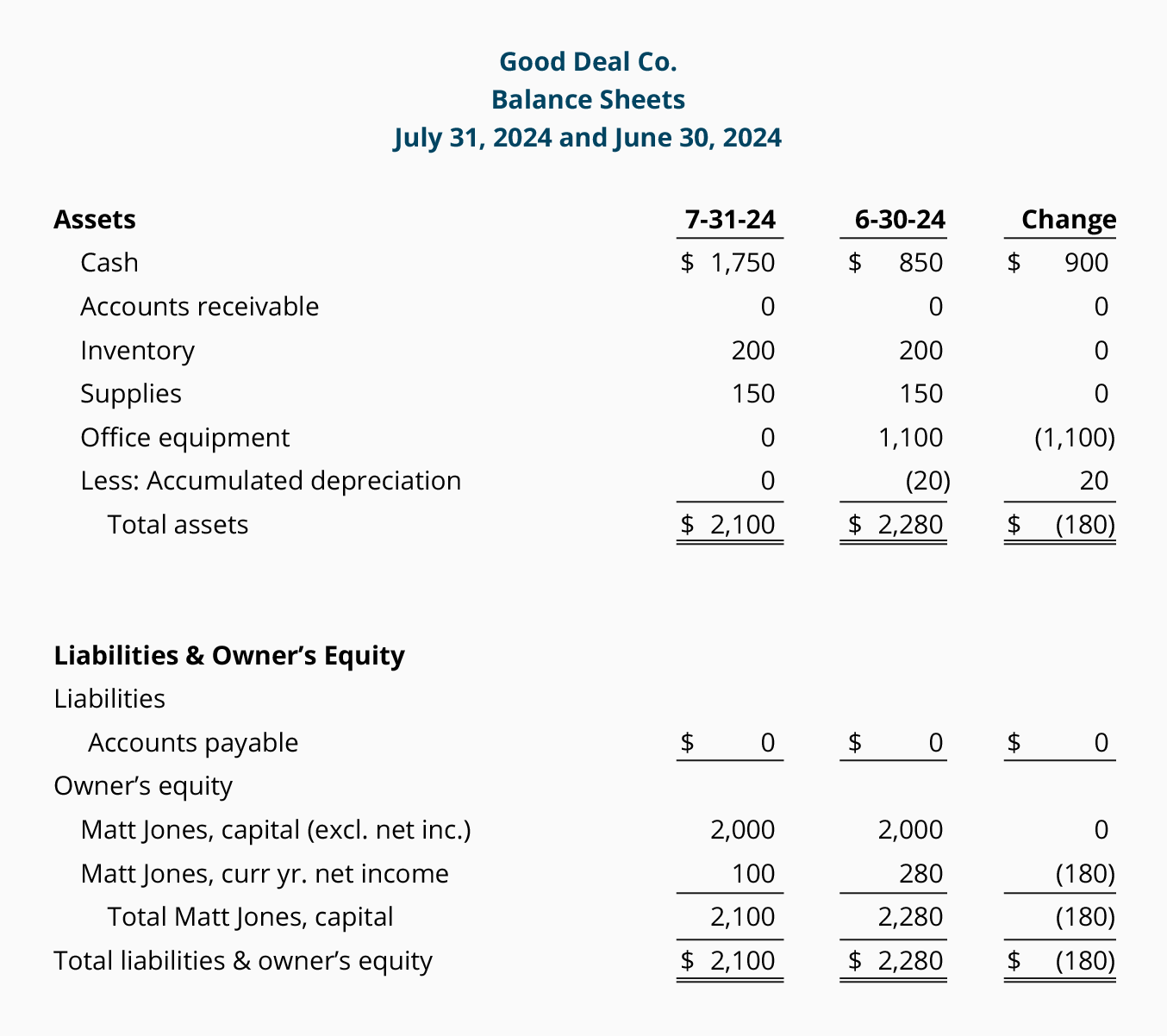

Consider a company with a share price of 10 and 100 million shares outstanding. -10000 Fixed assets -10000 fixed asset purchases -23000 Cash flow from assets. Operating cash flow capital spending and change in.

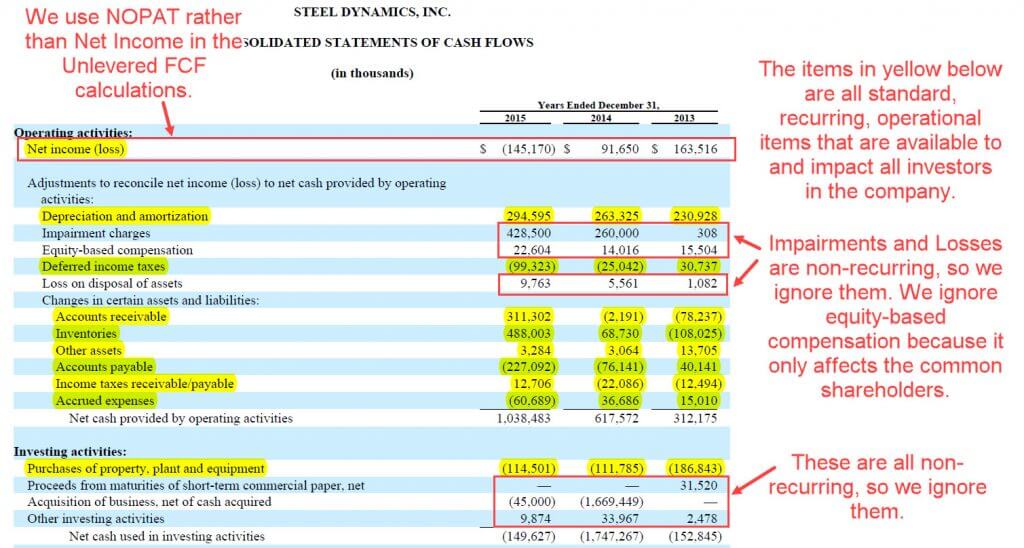

But we replace net income with CFO. Cash return on assets cash ROA Cash return on assets is similar to return on assets. Heres how this formula would work.

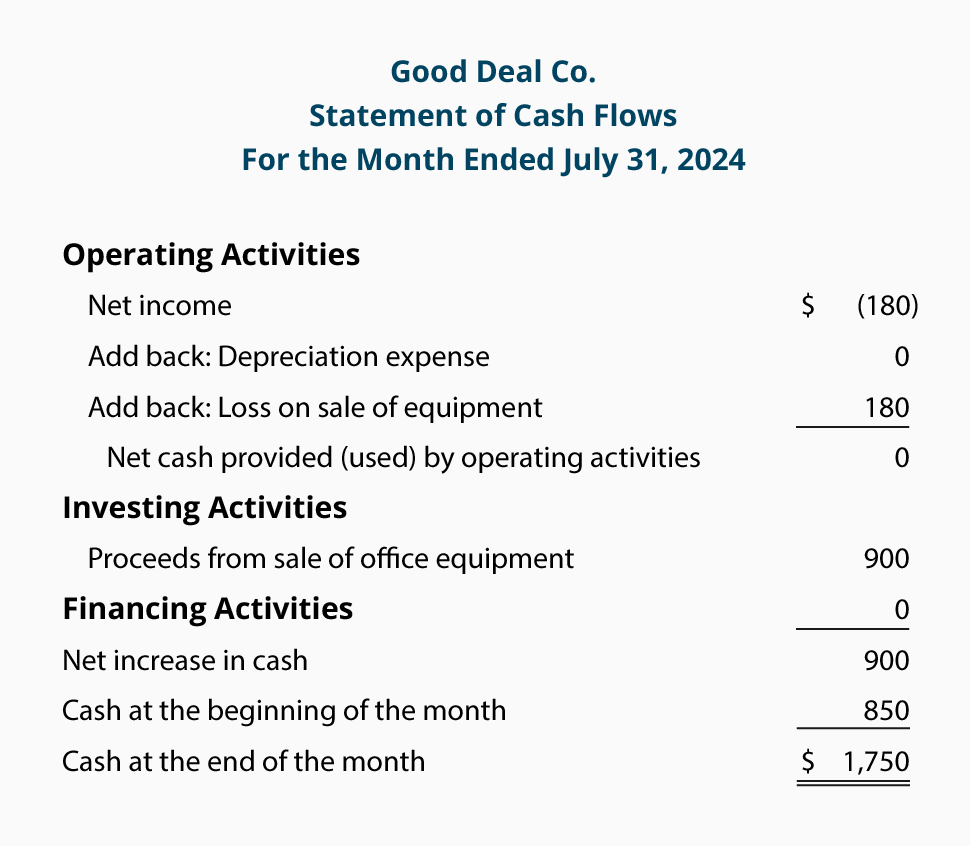

How to Create Positive Cash Flow. Here are some examples of how to calculate cash flow from assets. Price to Cash Flow Ratio Example.

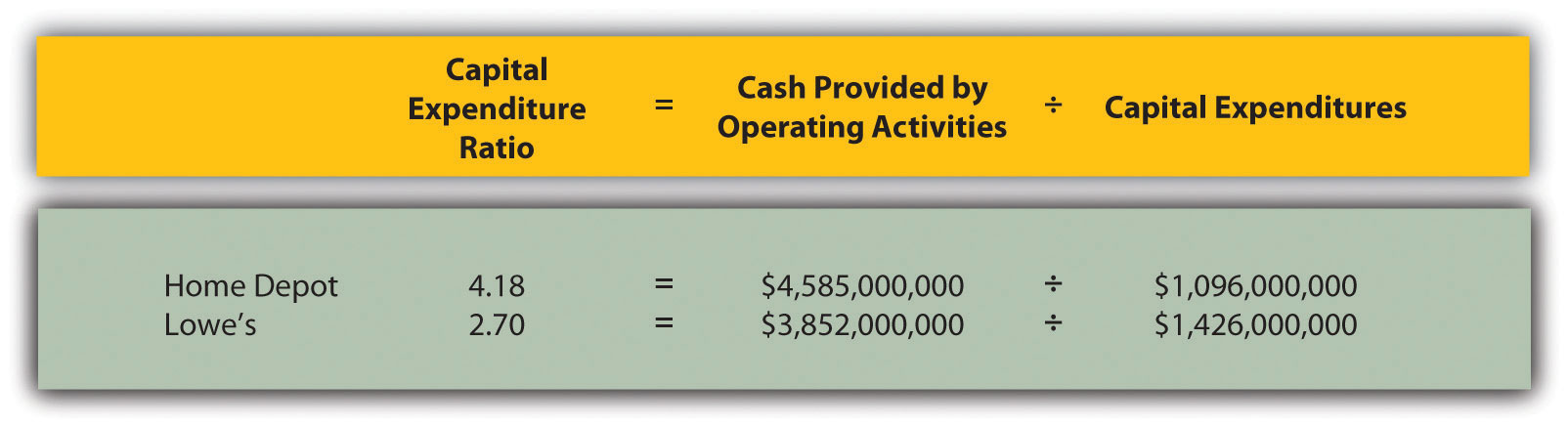

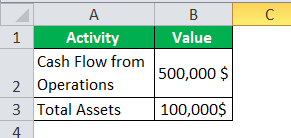

The price-to-cash flow multiple is primarily used in the comparable analysis method of stock valuation. Cash flow from assets formula cash flow from operation net working capital change in fixed assets. Then well calculate the PCF ratio by dividing the market capitalization by cash from operations CFO as opposed to net income.

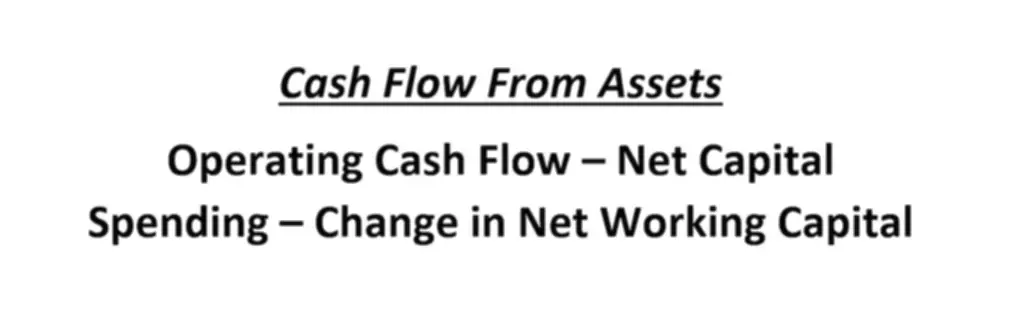

Company A Price-to-Cash Flow Ratio PCF 3bn. Cash flow from assets is the total cash flow to creditors and cash flow to stockholders consisting of the following. N Net capitalspending.

Equation for calculate cash flow from assets is Cash Flow From Assets f - n - w Where f Operating cash flow. 50 15. Johnson Paper Company is a family company that.

Current Stock Price Cash Flow per Share. W Changes in net working capital. Example of calculating cash flow from assets.

10000 inventory -10000 Fixed assets -10000 fixed asset. CFFA 20000 -8000 -2000 10000 This calculation of cash. From the definition the.

200Million100MillionShares2fractext200 Milliontext100 Million Shares 2100MillionShares200Million2 The company t See more. Now we will calculate cash flow from operations for the company. Management can generate positive cash flow.

In case of Frost we need to estimate operating cash flows and then work out PCF. Unlike the PE ratio the price-to-cash-flow ratio. Assume EV Company a metal fabricator has an operating cash flow of 300 million within a year a per-share price of 15 and 100 million.

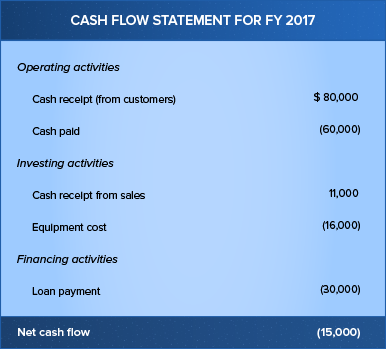

Cash Flow Cash from operating activities - Cash from investing activities - Cash from financing activities Beginning cash balance.

Net Cash Flow An Overview Sciencedirect Topics

Analyzing Cash Flow Information

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

What Is A Cash Flow Statement Example Of Cash Flow Statement Zoho Books

Price To Cash Flow Formula Example Calculate P Cf Ratio

What Is Cash Flow Formula And How To Calculate It

Disposal Of Assets Disposal Of Assets Accountingcoach

Direct Approach To The Statement Of Cash Flows Principlesofaccounting Com

Ifb68 A Simple Balance Sheet Primer For Beginners Investing For Beginners 101

Cash Flow From Operations Ratio Formula Examples

How To Do A Cash Flow Analysis With Examples Lendingtree

Cash Flow From Assets Definition And Formula Bookstime

Types Of Cash Flow Operating Investing And Financing Explained Upwork

Disposal Of Assets Disposal Of Assets Accountingcoach

How To Calculate Cash Flow 3 Cash Flow Formulas Calculations And Examples

How To Calculate Net Cash Flow Gocardless

Solved Titan Football Manufacturing Had The Following Operating Results Course Hero